north dakota sales tax refund

North Dakota has a destination-based sales tax system so you have to pay. Additionally the state reduces the tax rate for business taxpayers purchasing new farm.

How To File And Pay Sales Tax In North Dakota Taxvalet

Ad Have you expanded beyond marketplace selling.

. 127 Bismarck ND 58505. North Dakota sales tax payments. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of.

Taxable purchases must be a least. And owned their house for fewer than 3 years but have been a South Dakota resident for 5 years or more. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

Avalara can help your business. North Dakota Office of State Tax Commissioner Sales Special Taxes 600 E. North Dakota has recent rate changes Thu Jul 01.

The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions. Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. Written Determinations Sales and Use Tax.

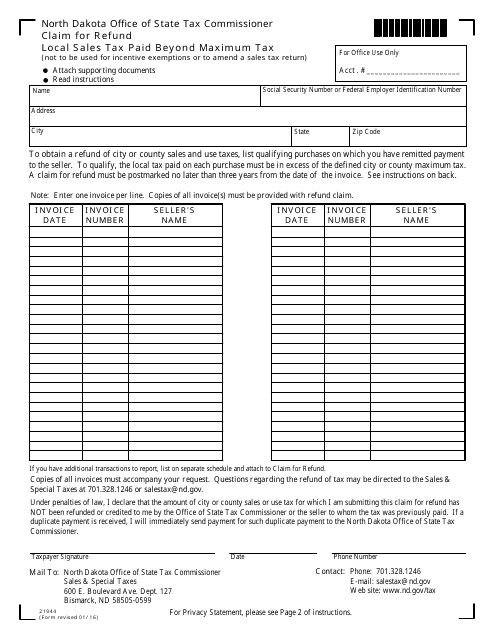

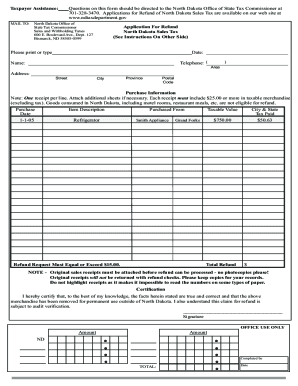

A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E. Form 306 - Income Tax Withholding Return. Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes.

With local taxes the total sales tax rate is between 5000 and 8500. The state sales tax rate in North Dakota is 5000. How to File Sales and Use Tax Resources.

On top of the state sales tax there may be one or more local sales taxes as well. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. The state-wide sales tax in North Dakota is 5.

Refund Applied to Debt. Canadian residents may obtain a refund of North Dakota sales tax paid on qualifying purchases those purchased to be used exclusively outside the state. Ad Have you expanded beyond marketplace selling.

127 Bismarck ND 58505-0599 If you have additional transactions to report list on. North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD. Deadline to apply for the program is July 1 2021 and applications.

Avalara can help your business. Sales and Use Tax Revenue Law. Amended Returns and Refund Claims.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. New local taxes and changes to.

Refunds Things to Know. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be. Thursday June 23 2022 - 0900 am.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of. There are additional levels of sales tax at local jurisdictions too.

Direct Tax Accounting Social Brands Brand Stylist

How To File A Sales Tax Return In North Dakota

Where S My Refund Of North Dakota Taxes

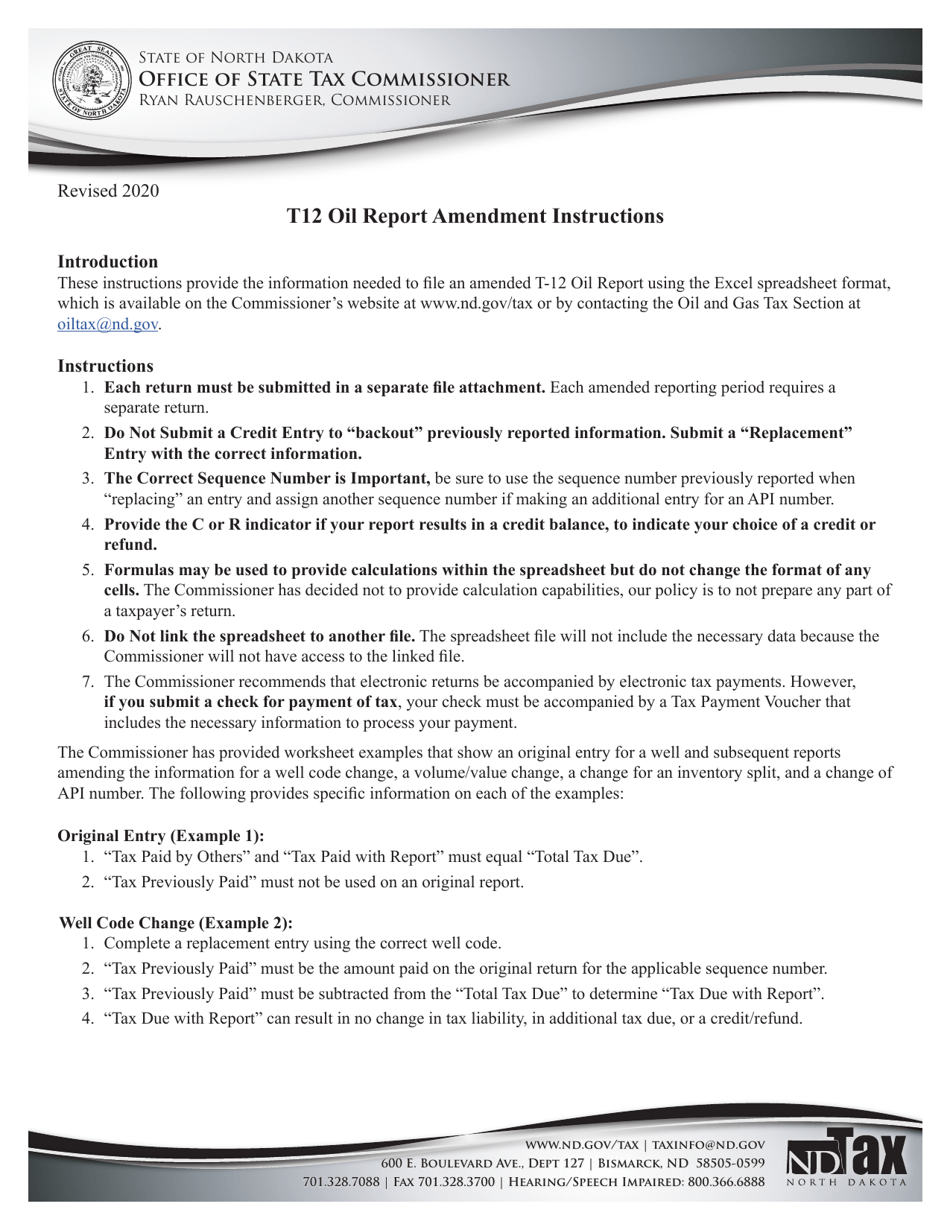

Download Instructions For Form T 12 Oil Gross Production And Oil Extraction Tax Report Pdf Templateroller

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

Https Www Thebalance Com Thmb Adcl9oxxhq2bqfmqfd7scukhyps 1333x1000 Smart Filters No Upscale States Without An Income Tax 36d1d40465 Income Tax Income Tax

How To File And Pay Sales Tax In North Dakota Taxvalet

Where S My Refund North Dakota H R Block

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs

Farmland Average Value Per Acre Per State Farm Rural Land Tax Refund

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Nd State Tax Refund Tax Brackets Taxact

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Tax Refund Canada Fill Online Printable Fillable Blank Pdffiller

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

7 Tax Tips For Independent Contractors Remote Workers Independent Contractor Business Blog Remote Workers

North Dakota Tax Refund Canada Form Fill Out And Sign Printable Pdf Template Signnow

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller